DRAM prices are falling down consistently since the last year and there is no surprise that this is going to be the case for the next months too.

While the market took some time to adjust to DDR5 memories, the prices of these kits have fallen significantly in the first quarter of this year alone. But this doesn’t seem to be stopping here as the PC market looks stagnant and there is already more supply than demand.

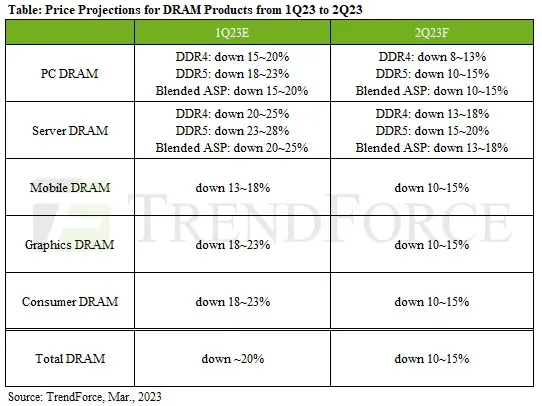

According to a new report published by TrendForce, the DRAM ASP(Average Selling Prices) are going to decline even further in the next quarter by 10-15%.

This is common amongst all the different segments of the PC market whether you consider PC, Servers, Mobile, or Graphics. Trendforce has published the price predictions for the DRAM products from the 1st to 2nd Quarter as shown in the table below.

DRAM across all the segments has seen a steady decline that ranges from 13-28%. Here, PC DRAM saw a price decline of 15-20% for DDR4 and 18-23% for DDR5 memories in Q1.

A price reduction of about 8-13% for DDR4 and 10-15% for DDR5 is expected to follow in the second quarter because there is uncertainty if the demand will recover within this time frame.

Many suppliers like Micron and SK Hynix have started scaling back their DRAM production because the purchase quantity from buyers has reduced significantly. In the PC DRAM segment alone, it is reported that the buyers already have 9-13 weeks of PC DRAM in stock sitting idle.

PC OEMs, however, can take advantage of this situation by buying more DRAM for lower prices but it is still uncertain if suppliers will be able to fix the inventory issues.

The PC hardware market is not only seeing lower memory sales now than ever before but this is pretty much similar to what is happening to CPUs and GPUs. On one hand, we have Intel losing almost $700M in revenue and on the other, AMD also took a great loss in some of its segments.